Deploying On-Chain Arbitrage Bots on Binance Smart Chain (BSC) Using Python and Web3.py

Denwigwe Blossom

Denwigwe BlossomDeploying On-Chain Arbitrage Bots on Binance Smart Chain (BSC) Using Python and Web3.py

In the very busy world of cryptocurrency trading, on-chain arbitrage has become a lucrative strategy for investors looking to capitalise on price inefficiencies across decentralised exchanges. With the growing adoption of Binance Smart Chain (BSC) and its powerful API integrations, deploying an automated arbitrage bot has never been more feasible.

By leveraging Python and Web3.py, traders can build high-speed bots capable of scanning markets, executing trades, and securing profits in real-time. In this comprehensive guide, we’ll walk you through the step-by-step process of creating and deploying your own arbitrage bot on BSC.

Introduction to On-Chain Arbitrage on BSC

What Is On-Chain Arbitrage?

On-chain arbitrage is a crypto trading strategy that takes advantage of price differences between decentralised exchanges (DEXS) on the same blockchain. Unlike traditional arbitrage, which moves assets between centralized exchanges, on-chain arbitrage operates entirely within a blockchain network like Binance Smart Chain (BSC), Ethereum, or Solana.

Why Binance Smart Chain (BSC) for Arbitrage?

Binance Smart Chain (BSC) is an excellent choice for on-chain arbitrage due to its speed, affordability, and extensive DeFi ecosystem. One of the most compelling advantages of BSC is its low transaction fees, which are significantly cheaper than Ethereum’s gas costs. This allows traders to execute multiple arbitrage trades without excessive overhead, making it more profitable in the long run.

Another key benefit of BSC is its high-speed transactions, with block times averaging around 3 seconds per block. Speed is crucial in arbitrage trading because price discrepancies can disappear within seconds. The rapid transaction processing on BSC ensures traders can execute arbitrage opportunities quickly before market conditions change.

BSC's expansive DeFi ecosystem further enhances its appeal for arbitrage traders. It hosts numerous decentralized exchanges (DEXs), including PancakeSwap, ApeSwap, and BakerySwap, providing a variety of trading platforms where price differences can be exploited. The presence of multiple DEXs increases the chances of finding profitable arbitrage opportunities within the Binance Smart Chain network.

Additionally, BSC’s compatibility with Ethereum Virtual Machine (EVM) makes it easy for developers to integrate Web3.py and Python for automated trading. Since BSC supports Ethereum-based smart contracts, developers can build efficient bots that interact seamlessly with DeFi protocols on the network, streamlining arbitrage execution.

Liquidity and market opportunities also make BSC a prime choice for arbitrage trading. With large trading volumes and deep liquidity pools, traders can execute trades effectively without worrying about slippage. Furthermore, Binance Smart Chain supports cross-chain arbitrage, allowing traders to leverage price differences between BSC and other blockchain networks using cross-chain bridges.

How Python and Web3.py Facilitate Automated Trading

Python and Web3.py play a crucial role in facilitating automated trading on blockchain networks like Binance Smart Chain (BSC). These tools allow traders to build bots that interact with decentralised exchanges (DEXS), execute trades, and optimise arbitrage strategies efficiently.

Python is widely used in algorithmic trading because of its simplicity, versatility, and extensive libraries. It enables traders to write scripts that monitor price movements, analyse market trends, and automate trade execution. Popular Python libraries like Pandas, NumPy, and Scikit-learn help with data processing and strategy optimisation.

Web3.py, on the other hand, acts as a bridge between Python and the blockchain, allowing developers to interact with smart contracts and decentralized applications (dApps). Using Web3.py, traders can access real-time blockchain data, send transactions, and execute trades directly on BSC. It provides essential functions to connect wallets, fetch token prices, and interact with liquidity pools on DEXs like PancakeSwap and ApeSwap.

When combined, Python and Web3.py enable traders to develop fully automated arbitrage bots that scan price discrepancies across exchanges, trigger smart contract transactions, and optimize trade execution—all without manual intervention. This automation helps traders maximise profits, minimise human error, and increase trading efficiency in decentralised finance (DeFi).

How to Set Up Your Development Environment for On-Chain Arbitrage Bots on Binance Smart Chain (BSC) Using Python and Web3.py

Installing Python & Web3.py for BSC Integration

To install “Python” and “Web3.py” for Binance Smart Chain (BSC) integration, start by downloading and installing Python (recommended version: 3.8 or higher) from the official Python website (Download Python). After installation, confirm it by running `python --version` in your terminal or command prompt. This ensures that Python is correctly set up on your system.

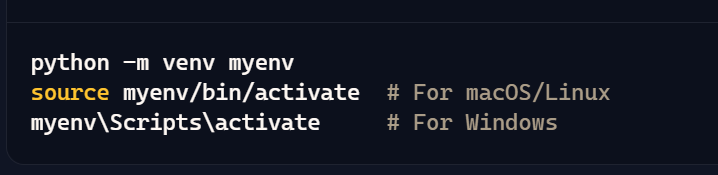

Setting up a virtual environment is highly recommended to manage dependencies and avoid conflicts. Create one using `python -m venv myenv`, then activate it using `source myenv/bin/activate` on macOS/Linux or `myenv\Scripts\activate` on Windows. This isolates your project and keeps it organized.

Next, install “Web3.py”, which enables interaction with the blockchain. You can do this by running `pip install web3`. To verify the installation, open a Python script and import Web3 by running `import web3`, followed by `print(web3.__version__)`, which should display the installed Web3.py version.

To improve Binance Smart Chain integration, install additional dependencies like `requests`, `pandas`, and `python-dotenv`. These libraries help with data fetching, market analysis, and secure management of environment variables. Install them using `pip install requests pandas python-dotenv`.

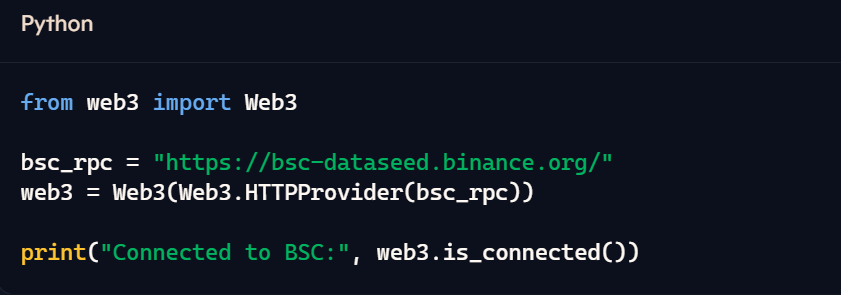

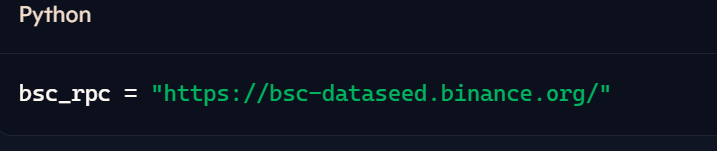

Once Web3.py is installed, you need to connect to Binance Smart Chain using its RPC endpoint. Set up the connection with the following Python script:

If the connection is successful, it will print `"Connected to BSC: True"`. This confirms that your system is ready to interact with the Binance Smart Chain.

Installing the Binance SDK is optional but useful for traders looking to integrate “Binance’s API” for price fetching and trade execution. It can be installed using `pip install python-binance`, which provides direct access to Binance market data and trading functionality.

With Python and Web3.py set up, you are ready to develop automated trading scripts, interact with smart contracts, and execute arbitrage strategies on Binance Smart Chain. Optimising gas costs, monitoring liquidity pools, and automating trade execution will help ensure efficient and profitable trading operations.

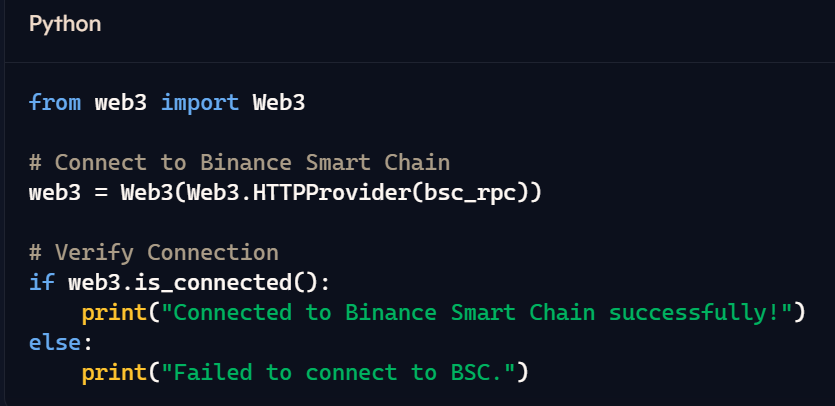

To connect to Binance Smart Chain (BSC) using Web3.py, follow these steps to establish a secure and reliable connection for blockchain interactions.

First, ensure you have Python and Web3.py installed. If not, install Web3.py using the command:

Once installed, you need an RPC endpoint to interact with Binance Smart Chain. BSC provides multiple public RPC nodes, and one commonly used endpoint is:

Now, import Web3 and establish a connection:

If the script prints "Connected to Binance Smart Chain successfully!", then the connection is active, and you can begin interacting with BSC.

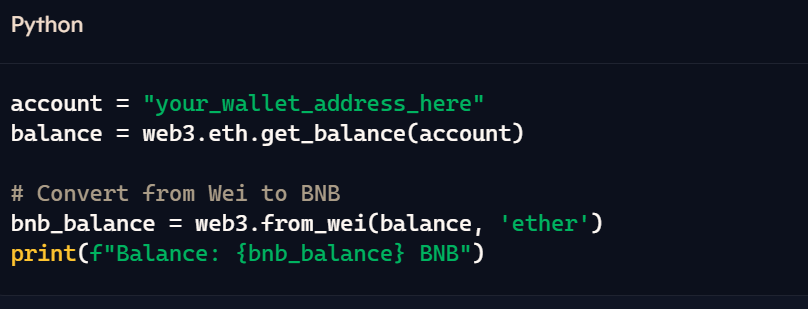

To interact with smart contracts, you need the contract address and ABI (Application Binary Interface). Use Web3.py functions to fetch balances, transactions, and more.

For example, to check your wallet balance, use the following:

This method retrieves your wallet’s BNB balance directly from the Binance Smart Chain network.

Once connected, you can deploy smart contracts, automate transactions, and interact with decentralized exchanges (DEXs) like PancakeSwap using Web3.py..

Essential Libraries and Tools for Arbitrage Bot Development

Developing an on-chain arbitrage bot requires the right set of libraries and tools to ensure efficient execution and seamless interaction with Binance Smart Chain (BSC). Here are the essential components you need to build a successful arbitrage bot using Python and Web3.py.

1. Web3.py – Blockchain Interaction

Web3.py is the core library that enables communication with BSC. It allows you to fetch token prices, execute transactions, and interact with smart contracts. Install it using:

2. Python-Binance – Access Binance API

If your bot needs to pull market data or execute trades directly on Binance, the python-binance library provides an easy-to-use API for trading. Install it using:

3. Pandas – Data Handling & Analysis

For efficient data management, pandas helps analyse market trends, track trade history, and organize price discrepancies between exchanges. Install it using:

4. NumPy – Optimised Calculations

NumPy is useful for performing complex calculations, such as price differentials and profit estimates. It enhances performance when processing large datasets. Install it using:

5. Requests – Fetch Real-Time Data

To interact with APIS and fetch price data from decentralised exchanges (DEXS), requests is a must-have library. Install it using:

6. Scikit-Learn – Machine Learning for Arbitrage Optimisation

For advanced arbitrage strategies, scikit-learn can be used to apply machine learning models to predict profitable trading opportunities. Install it using:

7. dotenv – Secure API Key Management

To securely store API keys and environment variables, python-dotenv is essential. It prevents exposing sensitive information in your bot’s code. Install it using:

Additional Tools for Arbitrage Bot Development

- TradingView API – For accessing charts and historical price data.

- MetaMask or Trust Wallet – For managing wallet addresses securely.

- Hardhat or Brownie – If deploying smart contracts for arbitrage automation.

With these libraries and tools, you can build a powerful arbitrage bot that scans market inefficiencies, executes trades instantly, and maximizes profit opportunities on Binance Smart Chain.

Understanding Arbitrage Strategies: How Arbitrage Works in Decentralized Finance (DeFi)

Arbitrage in Decentralized Finance (DeFi) is a strategy where traders profit from price differences between exchanges. Since DeFi operates across multiple platforms without central price controls, price variations often occur. Traders take advantage of these differences by buying assets at a lower price on one exchange and selling them at a higher price on another.

There are several types of DeFi arbitrage. DEX arbitrage involves trading tokens between decentralised exchanges to exploit price gaps. Cross-protocol arbitrage takes advantage of different interest rates on lending platforms. Triangular arbitrage happens when price differences between three assets on the same exchange create an opportunity for profit.

Automation plays a big role in DeFi arbitrage. Many traders use bots to scan markets and execute trades instantly, as price gaps are short-lived. However, risks like high gas fees, market volatility, and slippage must be considered when engaging in arbitrage.

Identifying Price Discrepancies on BSC

Identifying price discrepancies on Binance Smart Chain (BSC) involves monitoring bid-ask spreads, liquidity levels, and market volatility across different decentralized exchanges (DEXs). Since BSC hosts multiple trading platforms, price variations can occur due to differences in trading volume and liquidity.

One way to spot price discrepancies is by analyzing the bid-ask spread, which is the gap between the highest price buyers are willing to pay and the lowest price sellers are asking. Assets with lower liquidity tend to have wider spreads, making them more prone to price inefficiencies.

Another factor to consider is slippage, which happens when a trade executes at a price different from the expected price due to insufficient liquidity. Traders can minimize slippage by splitting large orders into smaller transactions.

For arbitrage opportunities, traders often use market-making and arbitrage tools to track price differences across exchanges. Automated bots can scan multiple platforms in real time, allowing traders to capitalize on price gaps before they close.

Types of Arbitrage Bots: Flash Loans vs. Traditional Arbitrage

Two common types are flash loan arbitrage bots and traditional arbitrage bots, each with distinct mechanisms and advantages.

Flash Loan Arbitrage Bots

Flash loans allow traders to borrow large amounts of cryptocurrency without collateral, provided they repay the loan within the same transaction. Flash loan arbitrage bots use this feature to exploit temporary price differences across decentralized exchanges (DEXs). These bots borrow funds, execute arbitrage trades, and repay the loan, all within a single transaction block. The main advantage is that traders don’t need upfront capital to execute high-value trades, making flash loan arbitrage highly accessible.

Traditional Arbitrage Bots

Unlike flash loan bots, traditional arbitrage bots operate using a trader's own funds or pre-funded accounts. These bots continuously scan DEXs for price discrepancies and execute trades once an opportunity arises. While they don’t rely on flash loans, they must account for gas fees, transaction delays, and liquidity availability. Traditional bots can function on both centralized and decentralized exchanges, making them more versatile.

Key Differences

Flash loan arbitrage bots and traditional arbitrage bots serve distinct purposes in DeFi trading. Flash loan arbitrage bots take advantage of flash loans, which allow traders to borrow large amounts of cryptocurrency without collateral, as long as the loan is repaid within the same transaction. These bots quickly identify price differences across decentralized exchanges (DEXs), borrow funds, execute arbitrage trades, and repay the loan—all within a single transaction block. The main advantage of flash loan bots is that they don’t require upfront capital, making them accessible to traders without large holdings.

On the other hand, traditional arbitrage bots operate using a trader's own funds or pre-funded accounts. These bots continuously scan DEXs for price discrepancies and execute trades whenever an opportunity arises. Unlike flash loan bots, traditional bots don’t rely on short-term lending but instead must account for gas fees, transaction delays, and liquidity availability. They offer greater flexibility since they can function across both centralized and decentralized exchanges.

Read Also: Blockchain In Supply Chain Management

While flash loan arbitrage bots enable instant execution and eliminate the need for initial investment, they come with risks such as smart contract failures. Traditional arbitrage bots, on the other hand, face challenges like market volatility and slippage, which can impact profitability. Choosing the right bot depends on a trader's strategy, available capital, and risk tolerance.

Building Your On-Chain Arbitrage Bot

Writing smart contracts for arbitrage execution involves designing automated programs that can identify price discrepancies across exchanges and execute profitable trades efficiently. These contracts operate on blockchain networks like Ethereum or Binance Smart Chain (BSC) and leverage decentralized exchanges (DEXs) for trading opportunities.

Key Components of Arbitrage Smart Contracts

- Price Fetching Mechanism: The smart contract must integrate with price oracles or directly query DEXs to compare token prices in real time.

- Trade Execution Logic: Once a price discrepancy is detected, the contract should execute a buy order on the lower-priced exchange and a sell order on the higher-priced exchange.

- Flash Loan Integration (Optional): To maximize capital efficiency, the contract can utilize flash loans to borrow funds temporarily without collateral and repay them within the same transaction.

- Gas Optimization: Since blockchain transactions incur fees, the contract should be optimized for minimal gas consumption to preserve profitability.

- Error Handling & Fail-Safes: The contract must account for unexpected price fluctuations, failed transactions, and liquidity issues to prevent losses.

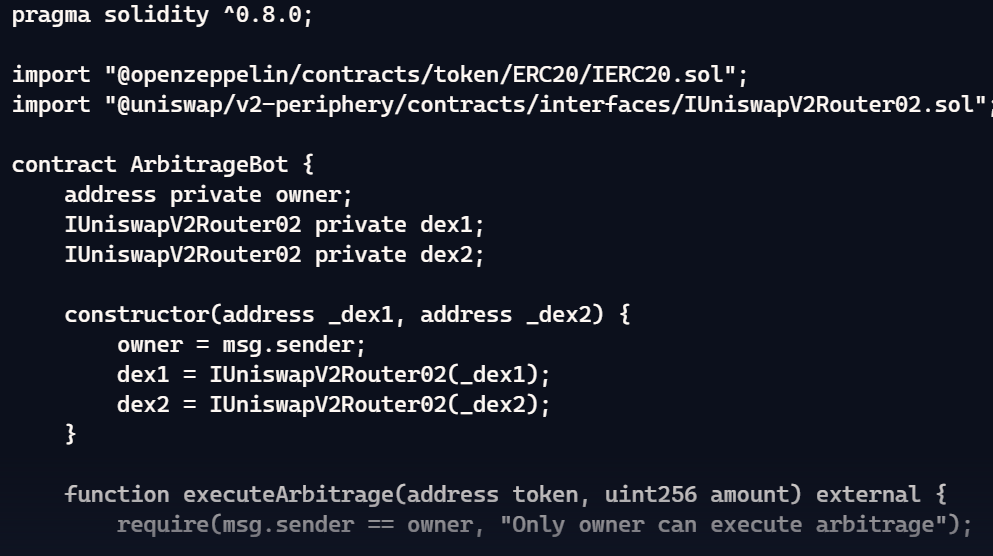

Example Structure (Solidity)

A simple arbitrage contract in Solidity might include functions for fetching prices, executing trades, and handling gas fees. It can look like this-

Automating Trade Execution with Python & Web3.py

Automating trade execution using Python and Web3.py enables traders to interact with blockchain networks, execute arbitrage strategies, and manage smart contract transactions programmatically. Web3.py is a powerful library that facilitates communication with Ethereum and Binance Smart Chain (BSC), allowing users to automate buying, selling, and liquidity monitoring.

Setting Up Web3.py for Automated Trading

- Install Dependencies: First, install Web3.py and any required libraries using pip-

- Connect to Blockchain: Establish a connection to an Ethereum or BSC node-

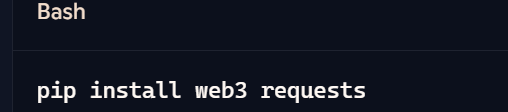

- Fetch Token Prices from DEXs: Use an API like PancakeSwap or Uniswap to retrieve token prices.

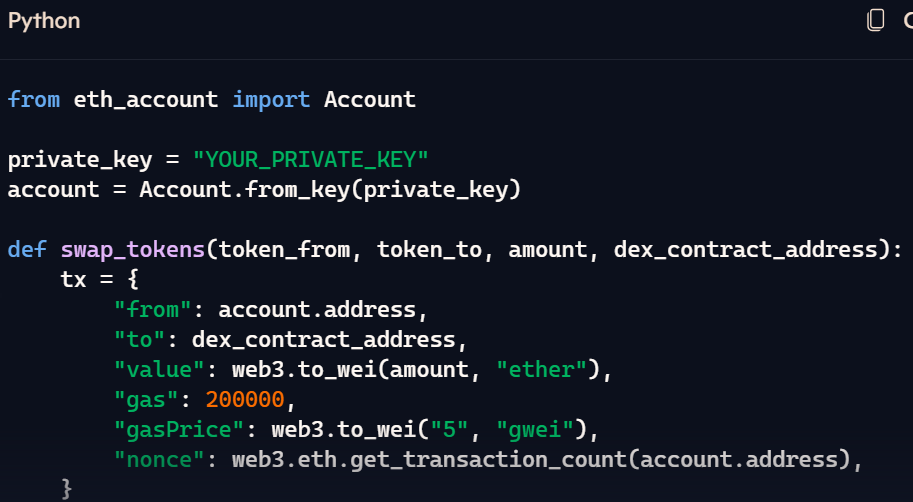

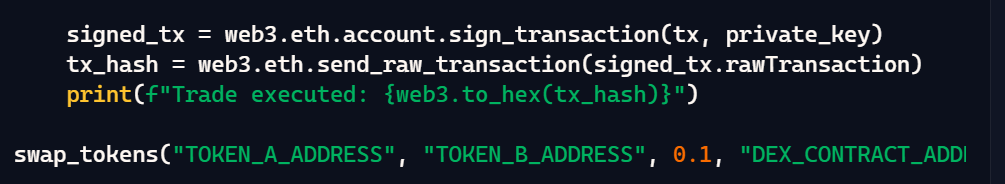

- Execute Trades Programmatically: Send a transaction to swap tokens when price discrepancies are detected-

Leverage Gas Optimisation Strategies:

Gas optimization is essential for maximizing profits in decentralized finance (DeFi) trading. Since blockchain transactions require fees, reducing gas costs can significantly improve overall profitability. One effective strategy is batch processing, where multiple transactions are grouped into a single operation to minimize fees. Instead of executing several separate trades, you can bundle them together to save on transaction costs.

Another approach is using Layer 2 solutions, such as Optimistic Rollups or zk-Rollups, which process transactions off-chain before finalizing them on the main blockchain. These solutions reduce gas fees while maintaining security and speed. Additionally, traders can optimize smart contract interactions by writing efficient code, eliminating unnecessary computations, and using gas-efficient functions.

Slippage control is also essential for ensuring trades execute at expected prices without unexpected losses due to market movements. By setting slippage tolerance limits within smart contract transactions, traders can prevent price discrepancies between the order and execution values. Using decentralized exchanges (DEXs) with deep liquidity pools also helps reduce the risk of significant price shifts during trading, ensuring more predictable outcomes.

With Bot automation trading efficiency is enhanced by continuously monitoring price changes and executing trades automatically. Using scripts integrated with Web3.py or other blockchain APIs, traders can track price fluctuations across exchanges, detect arbitrage opportunities, and complete transactions seamlessly. Automating trade execution eliminates human delays, allowing traders to maximise profit while maintaining control over gas fees and slippage conditions.

Deploying and Monitoring Your Arbitrage Bot

Deploying an arbitrage bot on Binance Smart Chain (BSC) involves several steps, from setting up a smart contract to monitoring trade execution. The first step is configuring your development environment, which includes installing Web3.py for Python or using Solidity for smart contract development. Developers typically interact with the BSC network via RPC endpoints and connect their bot to decentralized exchanges (DEXs) like PancakeSwap.

After setting up the bot's trading logic, the next step is deploying it on the blockchain. This involves writing and compiling smart contracts that define the bot’s behavior, including price monitoring, order execution, and gas optimization. The contract must be deployed using a tool like Remix IDE or Hardhat, and once published, the bot can begin scanning price discrepancies and executing trades automatically.

Monitoring the bot is crucial to ensure efficient operation and profitability. Traders can use blockchain explorers like BscScan to track transactions and verify trade execution. Additionally, integrating real-time logging tools and performance analytics helps identify areas for improvement. Automated alerts can also be set up to notify users of potential issues, such as failed transactions or fluctuating gas fees.

Debugging and Enhancing Your Arbitrage Bot Performance

Debugging and enhancing the performance of an arbitrage bot is crucial for maximizing efficiency and profitability. The first step in debugging is identifying errors and transaction failures by analyzing blockchain logs, reviewing execution paths, and checking for failed trades. Tools like Web3.py's debugging functions or blockchain explorers such as BscScan help track transactions and pinpoint issues.

Performance optimization involves reducing gas fees, improving trade execution speed, and fine-tuning algorithmic decision-making. Optimizing smart contract code by eliminating redundant computations and using gas-efficient functions can significantly lower transaction costs. Additionally, integrating real-time market analysis ensures the bot reacts swiftly to price discrepancies.

Enhancing automation with improved price tracking, slippage control, and adaptive trade execution helps the bot stay competitive. By leveraging machine learning algorithms or AI-driven predictive models, traders can refine their bot’s decision-making capabilities, increasing success rates.

Risk Management & Security Considerations

Risk management and security are crucial when operating an arbitrage bot in decentralized finance (DeFi). One of the primary risks is market volatility, where rapid price fluctuations can impact trade profitability. To mitigate this, traders can set slippage tolerance limits and use real-time monitoring tools to track sudden price movements.

Gas fee optimization is another key consideration, as high transaction costs can reduce profits. Executing trades during low network congestion and using gas-efficient smart contract functions can help manage expenses effectively.

Smart contract vulnerabilities pose security risks, especially when dealing with flash loans or automated transactions. Auditing smart contracts, using well-tested libraries, and implementing fail-safes against potential exploits can reduce the likelihood of security breaches.

Additionally, private key security is critical. Storing private keys securely, using hardware wallets, and enabling multi-factor authentication for transactions can prevent unauthorized access to funds.

How to Avoid Front-Running and MEV Attacks

Front-running and Maximal Extractable Value (MEV) attacks are significant risks in decentralized finance (DeFi), where traders manipulate transactions to gain an advantage. These attacks happen when malicious actors detect pending transactions in the blockchain’s public mempool and place their own orders first to capitalize on price movements. This practice can lead to losses for unsuspecting traders, making it essential to implement strategies to protect transactions.

To avoid front-running, traders can use private transactions, where orders are submitted through private RPC endpoints or services like Flashbots. This prevents front-runners from seeing and copying the trade before execution. Additionally, setting tight slippage limits ensures that trades only execute at expected prices, reducing vulnerability to price manipulation. Another effective strategy is batch transactions, which combine multiple operations into a single order, making it harder for attackers to anticipate and interfere with the trade.

MEV attacks are another challenge where miners or validators reorder transactions in a way that extracts maximum value from a trade. One way to mitigate this is by using transaction ordering protection, where certain MEV-aware decentralized exchanges (DEXs), such as Cowswap, optimize trade execution to prioritize fairness over miner profit extraction. Some smart contracts also allow time-locked transactions, ensuring that orders are only executed after a predetermined period, reducing front-running risks. Engaging with decentralized validators can further enhance trade security by minimizing manipulation. Implementing these strategies ensures a safer and more efficient trading environment.

The Future of On-Chain Arbitrage Trading

The future of on-chain arbitrage trading is set to become even more dynamic with advancements in blockchain technology and decentralized finance (DeFi). As networks become faster and more scalable, traders can execute arbitrage opportunities with lower latency and reduced gas fees. Cross-chain interoperability is also expected to play a significant role, allowing traders to take advantage of price discrepancies across multiple blockchain networks, rather than being limited to a single ecosystem like Ethereum or Binance Smart Chain (BSC). Additionally, improvements in privacy solutions and MEV-resistant protocols will make arbitrage trading more secure, reducing the risks of front-running and price manipulation.

Enhancing Bot Efficiency with Machine Learning

Machine learning is revolutionizing arbitrage bots by improving efficiency, predictive analytics, and trade execution. Traditional bots rely on predefined rules to identify arbitrage opportunities, but machine learning-powered bots can learn from historical data, adjust trading strategies in real-time, and predict market movements more effectively. AI-driven models can analyze patterns in liquidity, market depth, and volatility, allowing bots to optimize trade execution and avoid unnecessary losses due to slippage or unexpected price movements. Additionally, reinforcement learning algorithms enable bots to continuously refine their strategies, becoming more adaptive and resilient in volatile trading environments.